The challenge of reshoring: the example of semi-conductors

For the past two years, logistical disruptions and other shortages have created awareness of the high level of dependence of French and European industries. Textile, automotive, medical, food, IT… While many industries have been affected, one of the most striking examples concerns a component that has become essential in several sectors: semiconductors. Thanks in particular to the expertise of Thierry Tingaud, Vice-President of the FIEEC ( Federation of electrical, electronic and communication industries) , an update on the strategic challenges posed and the solutions implemented to meet them.

It is enough to take a look at the programs of the candidates for the presidential election to be sure: relocation is in fashion. Clearly, the supply disruptions linked to the health crisis have raised awareness of the risks posed by the dependence of many companies on distant factories, as on unique partners. Several actors reacted quickly. Le Coq Sportif, Aigle, Mulliez (textiles), Waterman (pens), Thomson (IT), Seqens (pharmacy), Malongo, Benedicta (food)… relocation projects are multiplying. Since 2020, their number would even be higher than that of relocations, a first since 2008 . Similarly, a barometer published in June 2021 by the firm EY shows that more than half of foreign companies established in France had the ambition to relocate activities there over the next three years.

French industrialists faced with the shortage of semiconductors

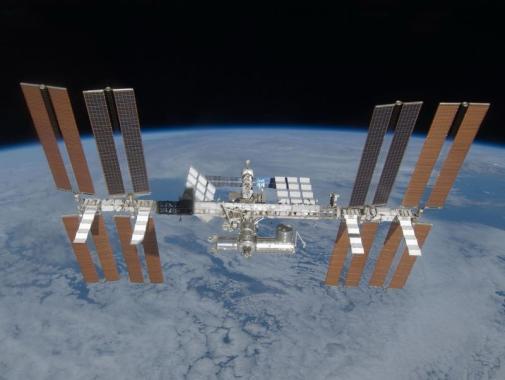

But here (as elsewhere), the will is not everything. The challenge of relocation is posed in very different terms depending on the sector. An illuminating example is given by the shortage of semiconductors which has impacted many industrial players. Automotive, industry 4.0, connected objects… Several areas in which French players are at the forefront have seen their activities heavily penalized due to the unavailability of this now essential electronic component – and set to become even more so in the future.

Thierry Tingaud, Chairman of the Strategic Committee for the electronics industry sector, thus returns to the chain reaction which has had a severe impact on these protagonists: " When the pandemic broke out in Europe, China, which was restarting its activity, made Massive orders of semiconductors for sectors benefiting from the explosion of teleworking around the world: printers, PCs, smartphones… These orders have saturated the factories worldwide ”.

In the face of uncertainty, the automotive sector, in particular, canceled its orders, while manufacturing capacities around the world were allocated to other sectors. As a result, in October-November 2021, when activity restarted, stocks were very low and production reserved, even though demand for electronic components was much stronger than before, due in particular to needs related to the energy transition. “ These different elements combine to lead to a situation of shortage in 2021, which will continue in 2022, or even at the beginning of 2023 ”, thus predicts Thierry Tingaud. In total, at the global level, the firm Alix Partners estimates that the shortages could have prevented the production of nearly 8 million vehicles in 2021 .

In response, massive investments...

Faced with the explosion of global orders, supply cannot keep up, also due to a lack of sufficient installed capacity. In this context, the main players in the electronics sector, in particular those whose production is implemented in France (Soitec, STMicroelectronic, X-Fab) have chosen to make significant investments. Up to 40% of annual turnover can be allocated between investment and Research & Development, relying in particular on State programs. This is how electronics was integrated into the relocation component of the recovery plan, with the signing of a sector contract (Nano2022 program) which runs from 2018 to 2022, which will be followed by a second plan within the framework of France 2030 itself included in the European plan of 750 billion euros.

Wishing to reduce the continent's dependence in this area, the European Commission presented its Chips Act plan in early February. Objective: to double the weight of Europe in the production of electronic chips by 2030, increasing from 10 to 20% of world production. An ambition that could seem limited in view of the envelope of nearly 50 billion planned by Brussels. But Thierry Tingaud recalls that “ no country or company is present on all dimensions, the sector is characterized by specializations by activities and value chains. In the various fields, the goal is to succeed in occupying a position in the first 5 world ranks, and thus to have strong positions within the world interdependence, vis-a-vis Japan, Korea, China, Taiwan or the States United ”.

To achieve these ambitions, Europe has certain assets. Important point: unlike others, two-thirds of French, Italian and German manufacturers of electronic components have thus maintained vertical integration (development, design, production) allowing them to still control part of the production and choice of 'allocation.

… for a necessarily gradual increase in power

However, it is impossible to adapt production capacity to the rate of growth in demand. “To increase the means of production in our professions, it is necessary to buy, for example, photolithography machines, which requires a period of between 12 and 14 months between placing the order and installation,” specifies Thierry Tingaud. The construction of a new factory will require between 3 and 4 years ”.

Similarly, however massive they may be, financial investments cannot be sufficient. Another key issue concerns human skills. “ We need talent , insists the Vice-President of the FIEEC. Training in the electronics sector is a truly decisive dimension. Here again, it is a question of working over the long term, of motivating schoolchildren for example. But we have real arguments to put forward, with international perspectives in a rapidly growing field which is, above all, a key activity of the energy transition ”. This is another exciting challenge which, like the relocation issue as a whole, will require a skilful combination of patience and determination.

Our other news

See allJoin the largest community of industrial suppliers

- Helping you with your ongoing technology watch

- Provide you with detailed supplier statistics

- Give you international visibility

Discover the largest catalogue of industrial products on the market

- To offer you the best catalogue of industrial products on the market

- To guarantee you a 100% secure platform

- Enable you to have live remote exchanges

Français

Français